Factoring

Alternative financing for freelancers

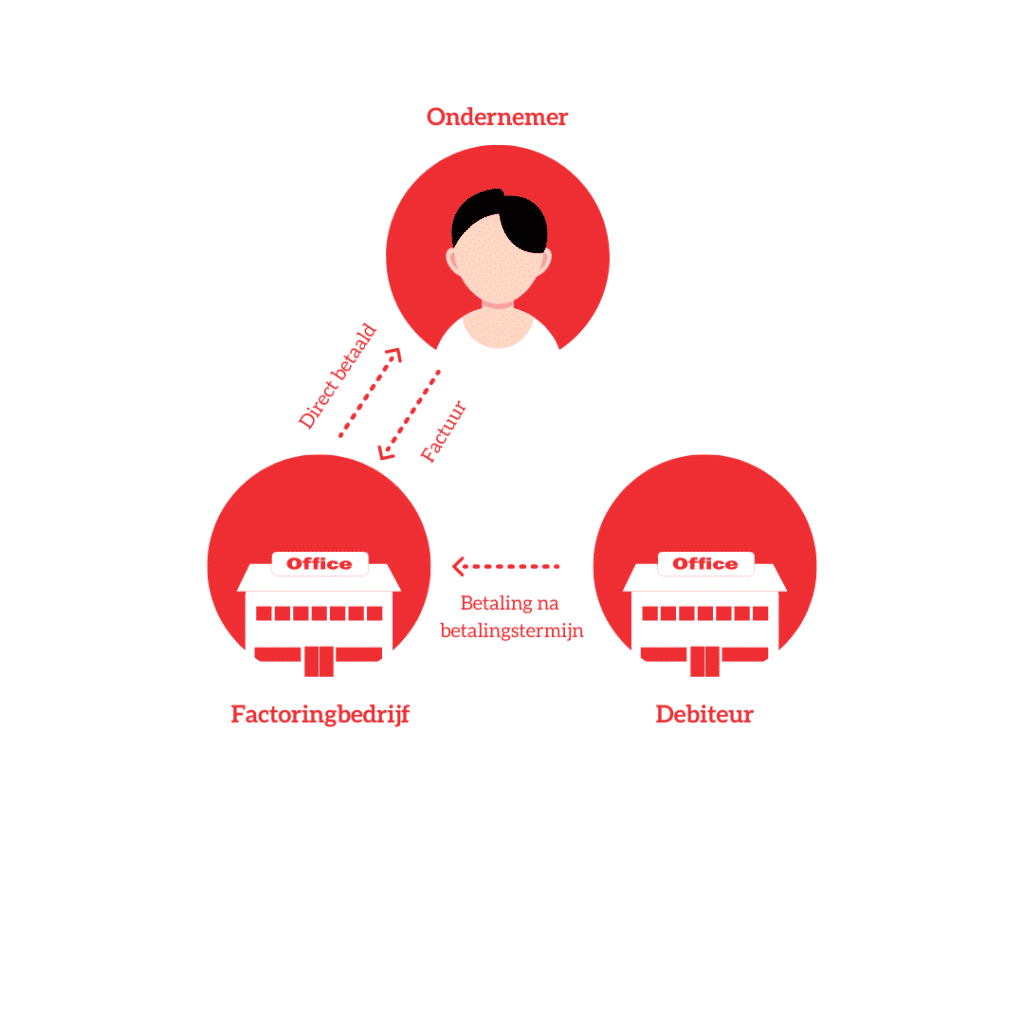

Factoring is a form of alternative financing for freelancers. You sell your invoice to a factoring company, then they pay your invoices to you within 24 hours. This gives you as a freelancer a better cash flow, because you are no longer dependent on a payment term.

What is factoring?

Your invoices paid within 24 hours

Factoring is a financial service where your invoices are paid immediately. Regardless of the payment term(s) of your client(s), the factoring company will pay your invoices immediately, they take over your debtor management and the risk of bankruptcy is insured. This allows you to fully focus on your business and your liquidity remains optimal.

How does factoring work?

We pay the invoice to you, then the customer pays us

You upload your invoice in your own layout, in your personal factoring portal. Then your invoice is paid within 24 hours, regardless of your customer’s payment term. Because the factoring company also takes over the administrative processing, it saves you a lot of time, and a lot of stress.

For whom is factoring interesting?

Factoring is interesting for every entrepreneur who does not want to wait any longer for his money. Unpaid invoices are a danger for both ZZP’ers, freelancers and SMEs. The longer a payment is delayed, the bigger the gap becomes and that can have unpleasant consequences. Risks are part of doing business, but fortunately you now know that we help you reduce the risks.

When to choose factoring?

Factoring is (extra) interesting in a number of cases

The benefits of factoring

No more worries about unpaid invoices

- Direct payment of your invoices

The big advantage of factoring is that payment of your invoice is in your account within 24 hours. - No worries about debtor management

You send your invoice and you no longer have to worry about debtor management. - Insured against bankruptcy

Because we check the creditworthiness of your customers in advance, we reduce the risk of non-payment. In the event of unjustified non-payment, you are insured against the risk of bankruptcy.

Two types of factoring

American factoring and traditional factoring

- American factoring is the most flexible form of factoring where you decide which invoices to sell to a factoring company.

- Traditional factoring is the form of factoring where you place your entire accounts receivable portfolio with a factoring company.

Debtor management

As a business owner, you undoubtedly spend time each month on debtor management, or making sure your invoices are paid on time. Of course, you want to be paid for the work you’ve done. If you use factoring, we take over your debtor management and insure the associated bankruptcy risk of your debtors.

Even if your creditworthy customers don’t pay, you get your invoices paid within 24 hours.

How are factoring costs determined?

Several factors have an impact

Why choose factoring at FreelanceFactoring?

For years the reliable partner of entrepreneurs

At FreelanceFactoring, we strive to think with all of our clients, which is why we offer everyone customized solutions. For each entrepreneur, we consider which factoring solution best suits the situation. We value personal contact and good service. All our clients have a fixed account manager who knows you as an entrepreneur and therefore knows exactly how you can best be helped.

What are the disadvantages of factoring?

Important in your consideration

- Using factoring always involves costs

- The factoring company you work with gets a lot of insight into your business

Therefore, it is important to do proper research on the factoring company you want to work with. Make sure you choose a reliable factoring partner.

Try us with 1 invoice

Don't wait any longer

Igor Meijs

Owner